The Disruptor

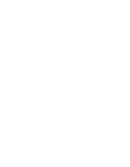

For more than two decades, Sandeep Tandon, B.S. EE ’90, M.S. EE ’91, has immersed himself in the world of technology. His creativity, innovation and willingness to challenge the old order have placed him among India’s most successful investors, executives and business owners.

“I love questioning why something is happening a certain way, then pushing the limits of trying to do it another, possibly better way,” said Tandon, managing director of the Tandon Group, a technology catalyst that provides financial and managerial assistance to 28 startups, mostly in India. “I get lit up from learning.”

Judging by his myriad business triumphs, Tandon has learned how to thrive in India’s cutthroat, high-tech world. One of his most recent successes, the multimillion-dollar sale of digital-wallet firm FreeCharge, reflects Tandon’s keen eye for profitable disruption opportunities.

FreeCharge, which he and Tandon Group manager Kunal Shah co-founded in 2010, became India’s fastest-growing mobile payment app. Tandon raised the company’s initial funding, built relationships with banks and telecommunications companies to build out the payment platform, and recruited key executives. FreeCharge makes it possible for millions of mostly young people to recharge metro cards, pay utility bills and make other mobile payments to service providers throughout India.

At a time when India remained largely a cash-based society, Tandon and Shah saw the upward trend in mobile phone ownership as an opening for a digital payments company. The pair launched FreeCharge, enticing millions of new users with digital coupons and incentives.

Their bet paid off handsomely. Tandon and Shah sold FreeCharge in 2015 to Snapdeal, an Indian online marketplace, for $400 million. The Times of India called it “one of the largest deals in the consumer Internet space in India.”

FreeCharge revolutionized and accelerated the digital payments ecosystem in India,” Tandon said. “The Tandon Group will continue to focus on finding game-changing platforms that serve the huge base of mobile internet users in India.

Under Tandon’s leadership, the group provided seed funding for Pianta, which offered a mobile appointment-booking platform for home health care services and was acquired by Indonesia-based Go-Jek last year for an undisclosed amount. Infinx, another promising medical startup funded by the Tandon Group, oversees billing and computer coding operations to help health care providers focus on patient care.

“I love the process of starting companies because it’s so liberating,” said Tandon, who has founded or co-founded six startups. “While you might have limited resources, there are no limits to your dreams.”

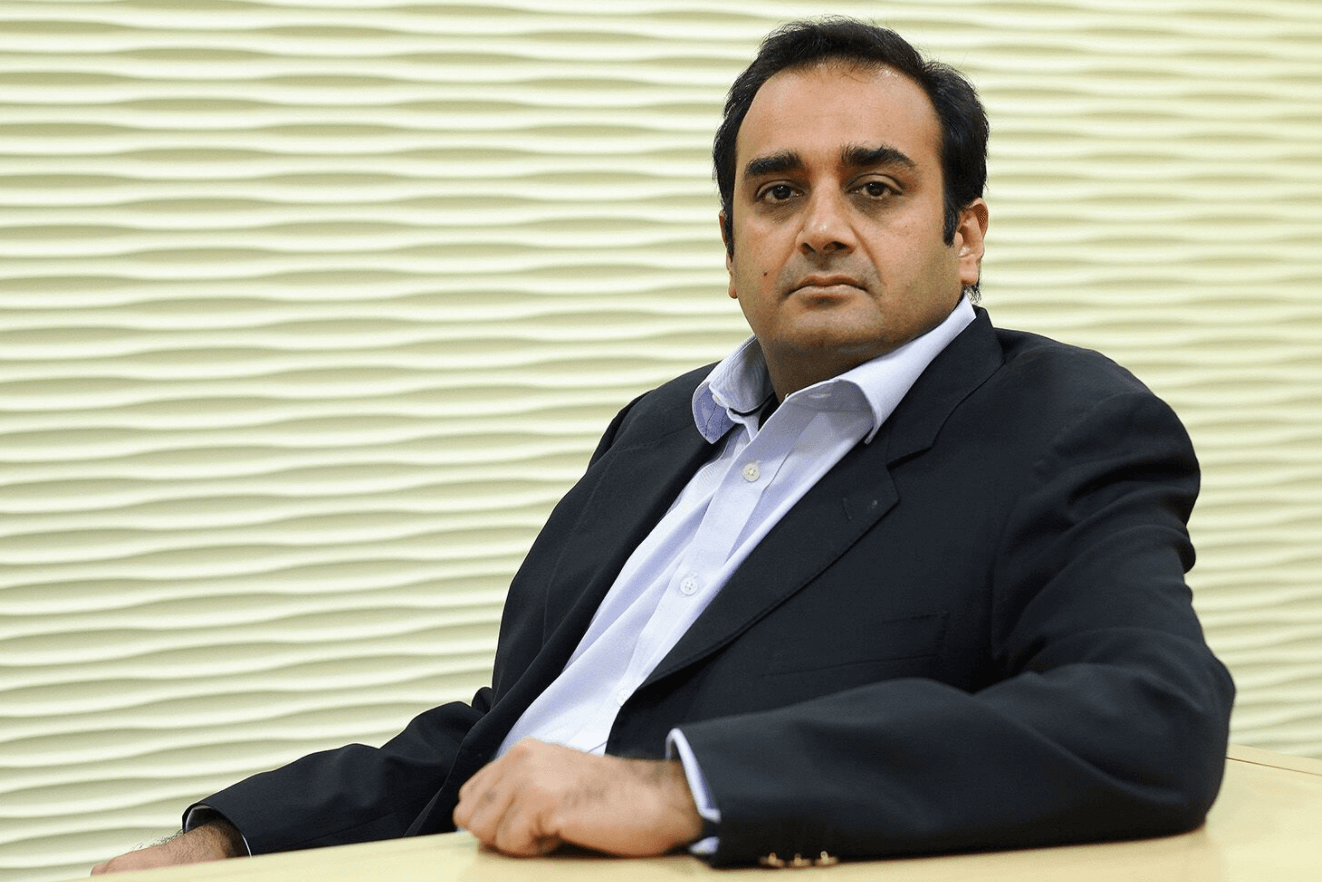

Tandon began his career in the United States but returned to his native India in 2003 to join the family business. His father, Manohar Lal Tandon, founded Tandon Magnetics in India in 1979 to manufacture for his brother’s U.S. based company, Tandon Computers. Under their direction, the partnership became the world’s largest independent producer of floppy drives for personal computers and word processors. Tandon Magnetics morphed into Tandon Group as the business expanded. In the early 2000s, the company shifted its focus to invest mostly in Indian startups in IT, medical services, e-commerce and financial services. Sandeep’s brothers, Jaideep Tandon, B.S. EE ’94, and Sudeep Tandon, B.S. CECS ’04, M.S. EE ’06, serve as Tandon Group directors.

“It’s a family affair,” Sandeep Tandon quipped.

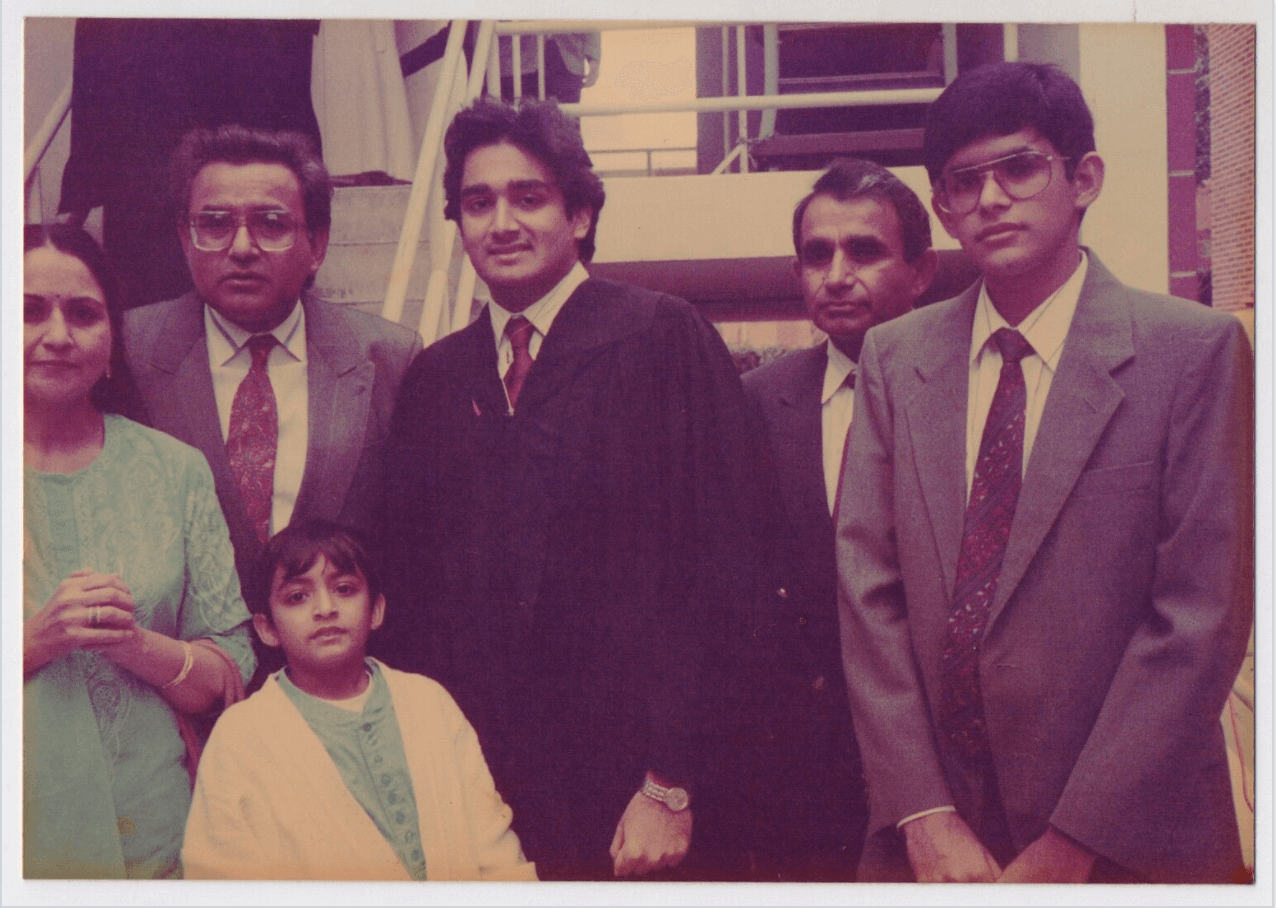

A proud Trojan, Tandon said studying engineering at USC “gave structure to my thoughts” and taught him how to break complex problems into small pieces to solve them.

“USC, it holds a very special place for me,” he said. “The TAs, professors and students were all there to help you.”

Now Tandon is there to help USC. For the past five years, he has served on the USC Viterbi India Board and hosted several alumni events at his family’s home in Mumbai.

“Sandeep has been one of the most important pillars of our expanding network in India,” said Dean Yannis C. Yortsos. “The Tandons are the quintessential Viterbi and Trojan family.”